Investing in Commodities or how to make profit from hunger

Five years ago, almost no one believed that oil prices would soar past $30 per barrel. $50 seemed utterly unthinkable. As oil prices continued climbing, so did disbelief. The skeptics never abandoned their misguided notion that oil was “overpriced.” So when crude retreated from $75 to $50 early last year, the prospect of $100 oil seemed like a ridiculous prediction

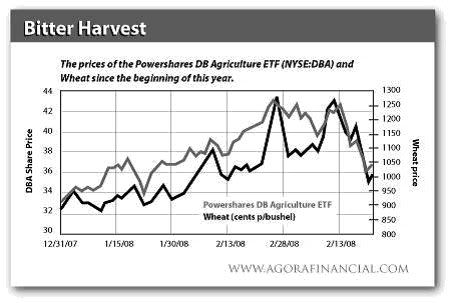

Due of Peak Oil, the prices of agricultural commodities are going much higher…

Most of the agricultural markets have had a big move already, but these markets could easily suffer a big correction from current levels. The long-term investor will want to buy these markets on weakness, not sell them.

A hundred years ago, the average American spent about 45% of annual income on food. Today, that figure is down to about 15%. So we’ve been taking cheap food for granted and have spent our “extra” cash on plasma TVs and leased BMWs.

We don’t worry about food costs or whether it will be readily available tomorrow. But the agricultural markets may have some major surprises in store for complacent Americans…and unprepared investors:

A Grainy Picture

While shortages of key industrial and energy commodities are frightening, no sector will threaten global stability more than agriculture…

In 2007, we saw stark glimpses of just how bad this situation will get. The “Tortilla Crisis” in Mexico, the “Pasta Protest” in Italy, the riots and crushing of one supermarket shopper in China over cooking oil… We have seen dairy, meat, and bread prices skyrocket.

It’s ironic that as global population is reaching an all-time high, we are turning a huge percentage of our crops into ethanol or biofuel…

This questionable, if not idiotic, alternative produces little, if any, short-term benefit and considerable long-term harm — both to the quality of farmland and to the integrity and stability of the global agriculture markets. In other words, using food as fuel can make a big mess out of the global food supply…and the prices that we all pay for that supply.

From sea to shining sea, the U.S. has croplands as far as the eye can see. For years, its bounty has been a supermarket for the world. Now it’s a fuel station, too.

China, which has hundreds of millions more hungry mouths than we have, has far less arable farmland. And worse, China has far fewer controls in place to regulate farming methods.

Trends like these strongly suggest that the agricultural markets will imitate the price action of the energy markets. As investors, we must look at this situation as an opportunity…

[...]

Labels: Results of Deregulation. Results of ditching FDR Farm Price Supports. Speculation.

0 Comments:

Post a Comment

<< Home